Canada Revenue Agency outage causing some delay for those seeking an instant refund.

WOODSTOCK -- Problems related to a major breach with Canada Revenue Agency's web site have been having some effects on local businesses helping you with your taxes.

Nine-hundred Canadians have had their social insurance numbers stolen from the Canada Revenue Agency's systems after CRA's online services were hit by the so-called Heartbleed bug.

The Heartbleed virus is caused by a flaw in Open SSL software, which is commonly used on the Internet to provide security and privacy.

Faith Hutchison with Liberty Tax on Dundas Street in Woodstock says CRA's problems from the "Heartbleed Bug'' have contributed to a few days of slow business and also some other delays when it comes to processing returns.

"The biggest effect it has on us is that we can't send our files into the government. So, in that case we couldn't do the instant refunds for people while Canada Revenue was down, so that's the biggest problem we've run into. Having said that, most people who have been asking for instant refunds have already been in to do that, they do it as soon as they get their forms," said Hutchison Monday.

Tax preparers who rely on E-File and Netfile to send returns were unable to send in those forms for processing, something Hutchison says is a small backlog which needed to be cleared beginning with work done on Monday.

"We've had to have someone sitting down actually processing those returns to the government and while we have them already to go -- It's a matter of getting them sent off, which usually on its own is a small process, but when you have them stacked up, it can take some time."

Canada Revenue's online services were back up and running Sunday after government sites were disabled last week to address the security risk.

The agency moved to block public access to its services to address the risk but says there was still a six-hour data breach.

Perhaps still help for some, Hutchison says that because of the recent service interruption, those who owe money on their taxes now have a later deadline to file their returns this year.

"It's now been changed to May 5, Canada Revenue will accept anything up until May 5 and without considering it late and applying no penalties to that."

For those who still have yet to file, Hutchison has a few tips:

-Remember your T-4, or T-4A if you're on a pension.

-Always have your property taxes or rent receipts because they can impact what you may get back from the Ontario Trillium Plan.

-Families should remember any forms which may have an impact on any dependents living in their household.

Meanwhile, CRA says it's now putting measures in place to protect those affected by the breach, notifying the people by registered mail, and offering them free access to credit protection services.

Blood for Byers Event is in Woodstock

Blood for Byers Event is in Woodstock

Thamesford Man Caught for Impaired Driving

Thamesford Man Caught for Impaired Driving

STAGES Program Brings Shows to Theatre Woodstock

STAGES Program Brings Shows to Theatre Woodstock

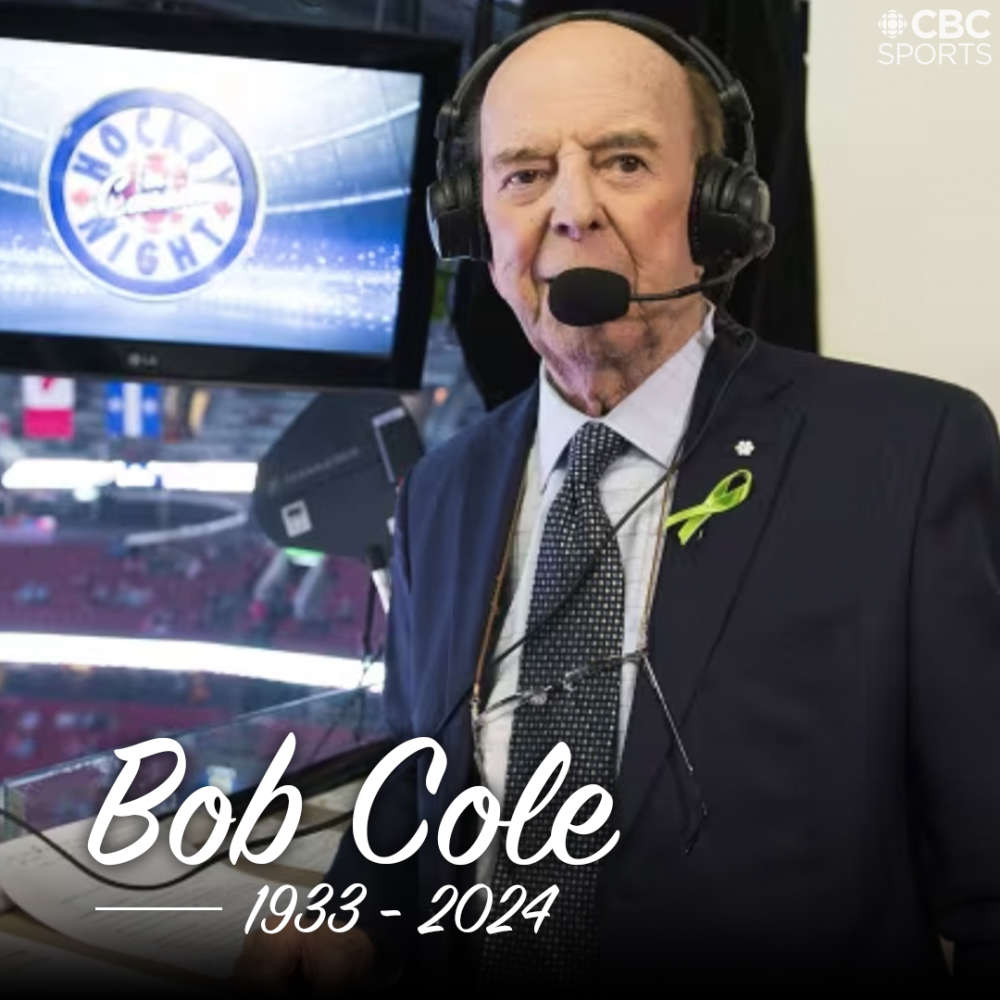

Bob Cole Dies at the Age of 90

Bob Cole Dies at the Age of 90

County Discusses Safety Concerns During Pride Events

County Discusses Safety Concerns During Pride Events

BBBS of Oxford Calling for Mentors

BBBS of Oxford Calling for Mentors

OCNVA Preparing for Battle of the Atlantic Commemoration

OCNVA Preparing for Battle of the Atlantic Commemoration

Woodstock Sports Fields Not Open Yet

Woodstock Sports Fields Not Open Yet

Sister Cities Logo Finalists

Sister Cities Logo Finalists

New Coaches Coming to Tavistock Braves

New Coaches Coming to Tavistock Braves

Norfolk OPP Investigation Leads to Charge

Norfolk OPP Investigation Leads to Charge

U14 Girls Oxford Attack Continue Season

U14 Girls Oxford Attack Continue Season

Province Increasing Speed Limit on 10 Sections of Highways

Province Increasing Speed Limit on 10 Sections of Highways

EZT Strategic Plan Survey Closing Soon

EZT Strategic Plan Survey Closing Soon

Realtors Care Food Drives Returns!

Realtors Care Food Drives Returns!

Plattsville Celebrates New Housing Complex

Plattsville Celebrates New Housing Complex

Two Have Licence Suspensions in Oxford

Two Have Licence Suspensions in Oxford

False 9-1-1 Calls Hit Norfolk County

False 9-1-1 Calls Hit Norfolk County

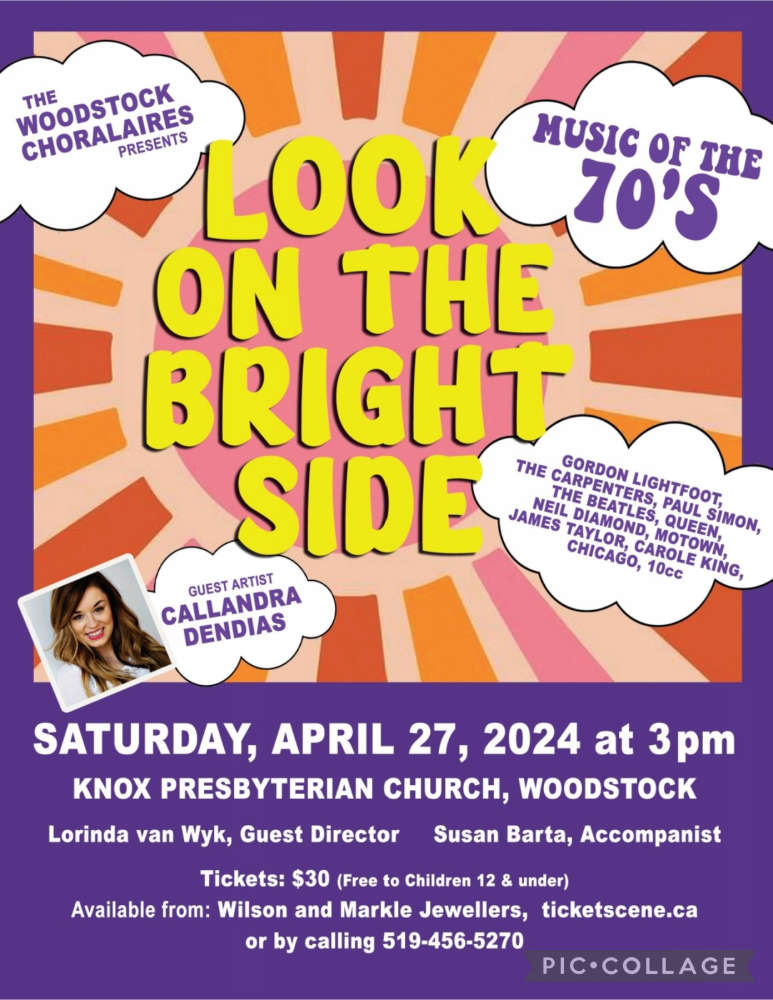

Woodstock Choralaires Hosting 70s Themed Show

Woodstock Choralaires Hosting 70s Themed Show

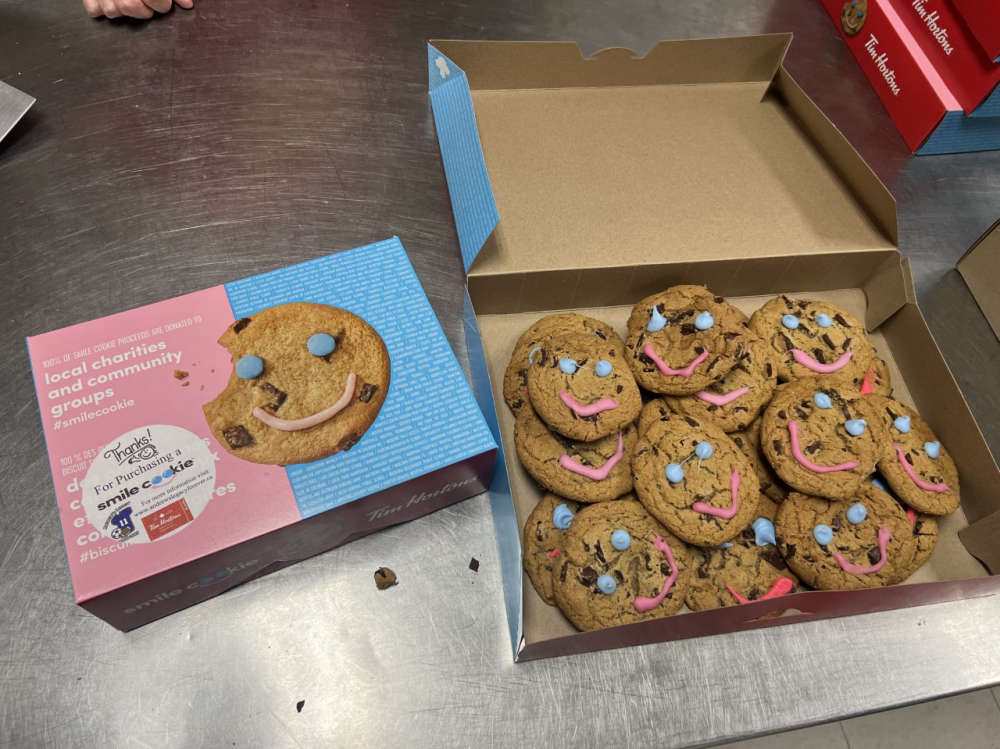

Thamesford Tim Hortons Accepting Smile Cookie Preorders

Thamesford Tim Hortons Accepting Smile Cookie Preorders

Comments

Add a comment