As Canadians scramble to get their taxes together, homeowners must remember new changes regarding house sales.

People who sold their homes over the last year should double check their tax returns.

Some new changes will be effecting Canadians according to Senior Vice President with BDO Canada Mike Braga.

"So there's new reporting requirements from the Canadian Revenue Agency for the sales of any principal residence. So if you sold your home after January 1st 2016 you need to report that on your tax returns."

This change only applies to principal residences accord to Braga.

"So its for your principal residence which can include a cottage, it can include your home as long as it was the primary place you were living throughout the last year."

When filling out the forms, homeowners will need to know the original date of purchase, the day the home sold, and the proceeds from the sale.

Failing to report the sale could mean a financial penalty of up to $8,000

SWPH Says No to Merger

SWPH Says No to Merger

Backlash Faced After Bylaw Talks

Backlash Faced After Bylaw Talks

Oxford County to Advocate for Better Rail Service

Oxford County to Advocate for Better Rail Service

Woodstonian Wins Big Off Scratch Ticket

Woodstonian Wins Big Off Scratch Ticket

UPDATE: Westbound Lanes Reopen Following Fatal Crash

UPDATE: Westbound Lanes Reopen Following Fatal Crash

Tillsonburg to Host Game 7 of WOHSL Cup Tonight

Tillsonburg to Host Game 7 of WOHSL Cup Tonight

Advanced Polls Open for Norwich Byelection Tomorrow

Advanced Polls Open for Norwich Byelection Tomorrow

Sexual Assault Investigation on Mile Hill Trail

Sexual Assault Investigation on Mile Hill Trail

Blood for Byers Event is in Woodstock

Blood for Byers Event is in Woodstock

Thamesford Man Caught for Impaired Driving

Thamesford Man Caught for Impaired Driving

STAGES Program Brings Shows to Theatre Woodstock

STAGES Program Brings Shows to Theatre Woodstock

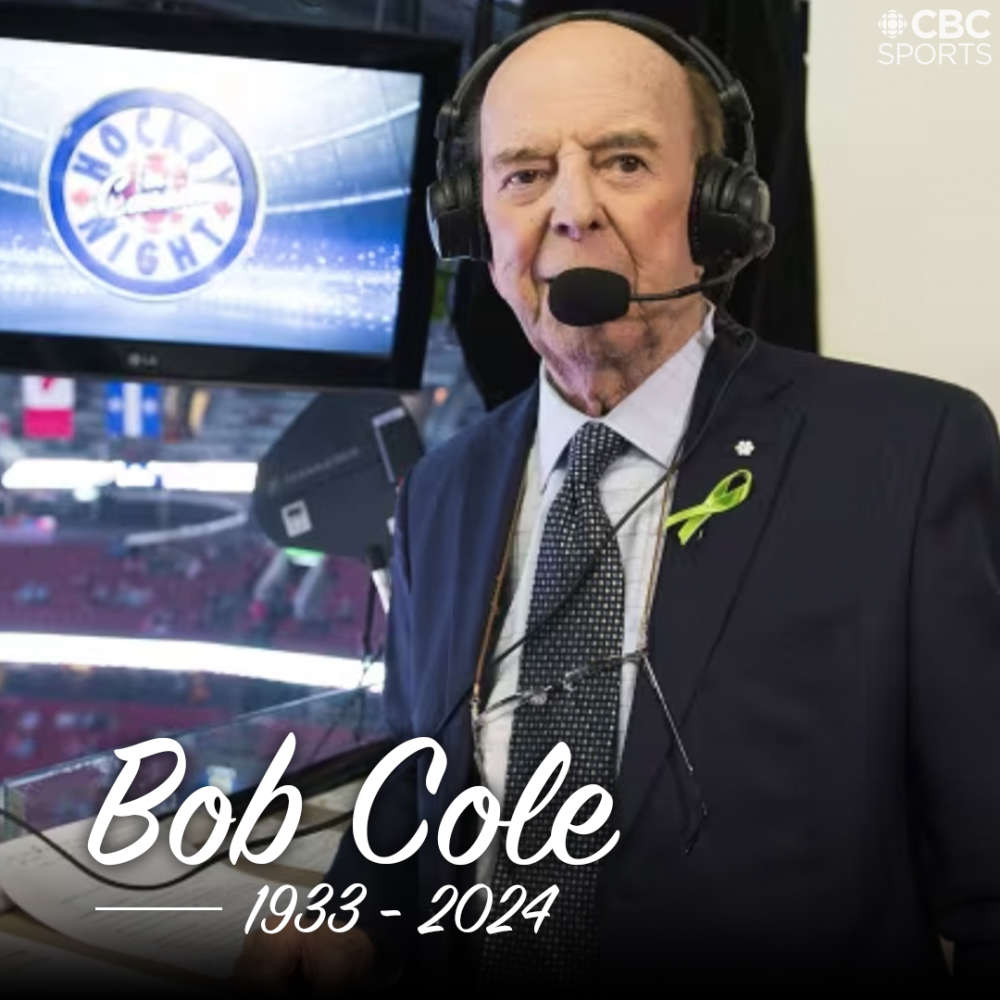

Bob Cole Dies at the Age of 90

Bob Cole Dies at the Age of 90

County Discusses Safety Concerns During Pride Events

County Discusses Safety Concerns During Pride Events

BBBS of Oxford Calling for Mentors

BBBS of Oxford Calling for Mentors

OCNVA Preparing for Battle of the Atlantic Commemoration

OCNVA Preparing for Battle of the Atlantic Commemoration

Woodstock Sports Fields Not Open Yet

Woodstock Sports Fields Not Open Yet

Sister Cities Logo Finalists

Sister Cities Logo Finalists

New Coaches Coming to Tavistock Braves

New Coaches Coming to Tavistock Braves

Norfolk OPP Investigation Leads to Charge

Norfolk OPP Investigation Leads to Charge

U14 Girls Oxford Attack Continue Season

U14 Girls Oxford Attack Continue Season