Bank of Canada raises interest rate from 0.25 percent to 0.5 percent

For the first time since 2018, the Bank of Canada has raised its key interest rate.

The rate now sits at 0.5 percent, which is up from 0.25 percent.

The Bank of Canada lowered the interest rate to 0.25 percent in March 2020 to help the economy battle the pandemic.

The central bank is expected to implement several small hikes in interest rates this year to try to keep inflation down.

The rate set by the Bank of Canada impacts the rates Canadians get from their banks for mortgages, savings accounts and lines of credit.

The increase is expected to result in banks increasing their prime lending rates, thus increasing the cost of loans.

In response, both RBC and TD Bank say they are increasing their prime rates from 2.45 percent to 2.70 percent.

The change won't directly affect fixed-rate mortgages, but will increase the cost of loans such as variable-rate mortgages.

Multiple Charges Laid after Thefts in Tillsonburg

Multiple Charges Laid after Thefts in Tillsonburg

CASS Offering Unique Program to Students

CASS Offering Unique Program to Students

PJHL Preview - Jan. 30th to Feb. 1st

PJHL Preview - Jan. 30th to Feb. 1st

Woodstock Bowler Heading to Special Olympics

Woodstock Bowler Heading to Special Olympics

Dog Bite Investigation in Tillsonburg

Dog Bite Investigation in Tillsonburg

Interview with the Warden - January 29th, 2026

Interview with the Warden - January 29th, 2026

Trevor Birtch Trial Daily Recap - Case 2

Trevor Birtch Trial Daily Recap - Case 2

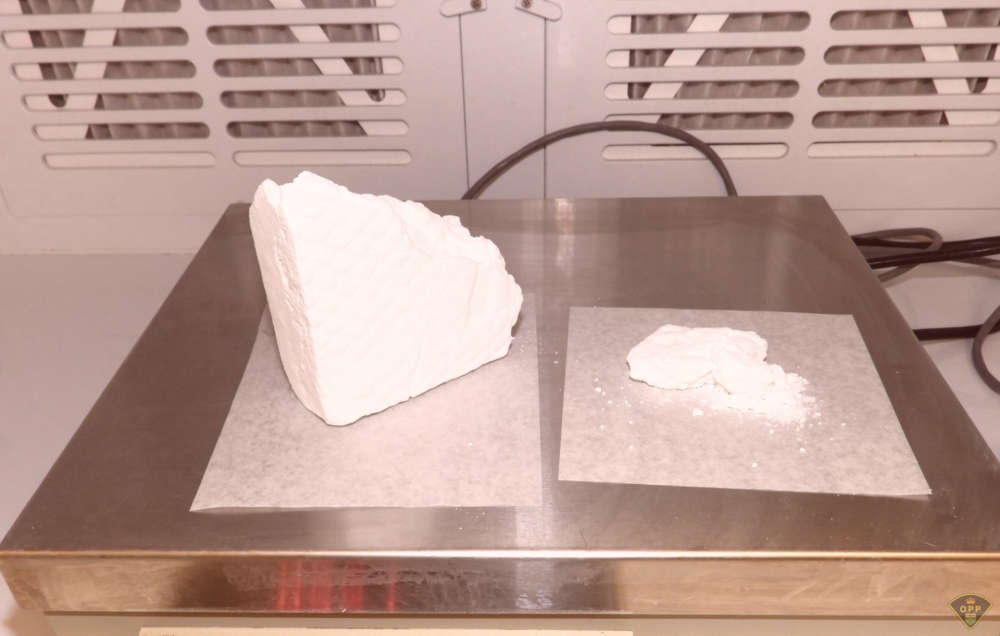

11 People Charged in Massive Drug Bust

11 People Charged in Massive Drug Bust

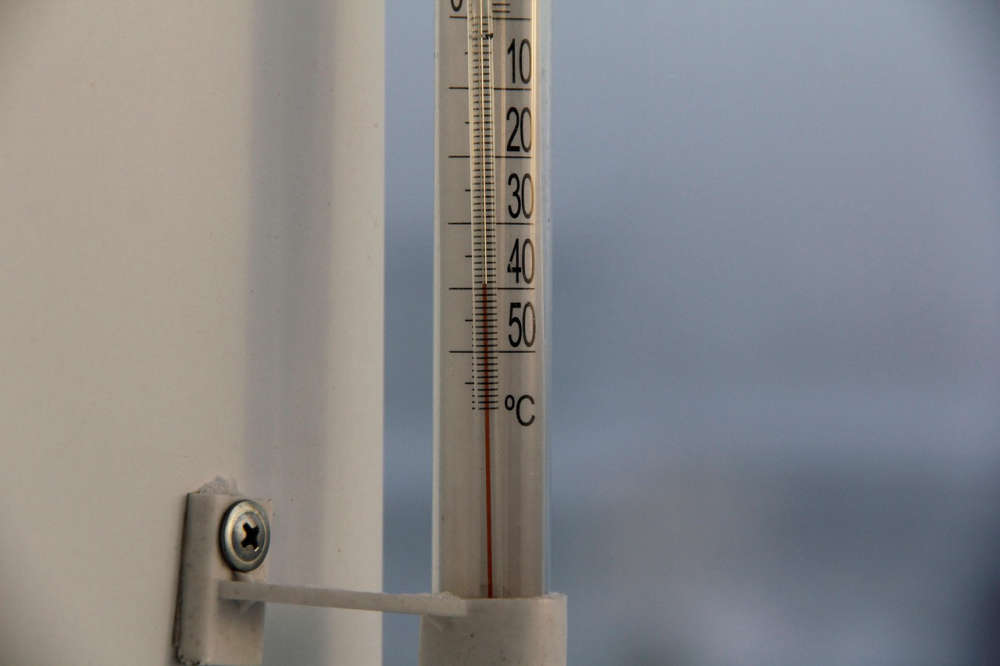

Another Cold Warning for Oxford County

Another Cold Warning for Oxford County

Chilly Charlie Returns on Monday

Chilly Charlie Returns on Monday

Khanna Shines a Light on Oxford County Superstars

Khanna Shines a Light on Oxford County Superstars

WFD Responds to Structure Fire

WFD Responds to Structure Fire

WPS Appoints New Deputy Chief

WPS Appoints New Deputy Chief

TMMC Woodstock Begins Production of Sixth Gen RAV4

TMMC Woodstock Begins Production of Sixth Gen RAV4

Oxford OPP Briefs - January 28th, 2026

Oxford OPP Briefs - January 28th, 2026

More Weather Alerts for Oxford County

More Weather Alerts for Oxford County

Thrive Oxford Honoured at ROMA

Thrive Oxford Honoured at ROMA

Tip Tuesday with the Oxford OPP - January 2026

Tip Tuesday with the Oxford OPP - January 2026

Members Needed for Tillsonburg Housing Advisory Committee

Members Needed for Tillsonburg Housing Advisory Committee

UPDATE: Ottawa Approves Plan to Move Marineland's Whales and Dolphins

UPDATE: Ottawa Approves Plan to Move Marineland's Whales and Dolphins

Comments

Add a comment