The average residential property owner will see an increase of $23 on their property taxes this year and the average farm-related property owner will see an increase of $40 this year.

OXFORD COUNTY - Property owners in Oxford County will see an increase on the county's portion of their property tax bill this year.

Warden Larry Martin says County Council has approved a bylaw to set the 2022 tax rate in stone.

"The average homeowner is going to be looking at about a $23 increase on their property taxes for the year, but that is based on a $250,000 assessment so you have to factor that in when you figure out the assessment your house is at."

He says the average farm-related property owner will see an increase of about $40 this year.

Martin adds Council didn't really consider changing the tax rate, because they haven't received a report from MPAC since 2016.

"If you look at the top change in property values from 2016 to 2022, I anticipate there's going to be a drastic jump when they do release their new assessment. It will be soon I'm assuming but we'll get it when we get it."

Council approved the 2022 property tax policy last Wednesday.

Multiple Charges Laid after Thefts in Tillsonburg

Multiple Charges Laid after Thefts in Tillsonburg

CASS Offering Unique Program to Students

CASS Offering Unique Program to Students

PJHL Preview - Jan. 30th to Feb. 1st

PJHL Preview - Jan. 30th to Feb. 1st

Woodstock Bowler Heading to Special Olympics

Woodstock Bowler Heading to Special Olympics

Dog Bite Investigation in Tillsonburg

Dog Bite Investigation in Tillsonburg

Interview with the Warden - January 29th, 2026

Interview with the Warden - January 29th, 2026

Trevor Birtch Trial Daily Recap - Case 2

Trevor Birtch Trial Daily Recap - Case 2

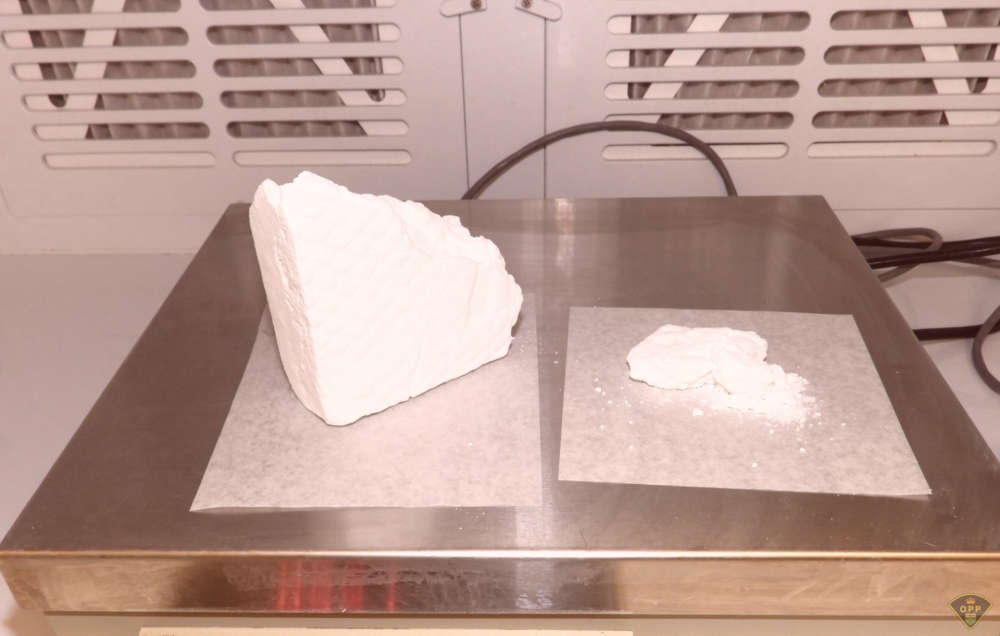

11 People Charged in Massive Drug Bust

11 People Charged in Massive Drug Bust

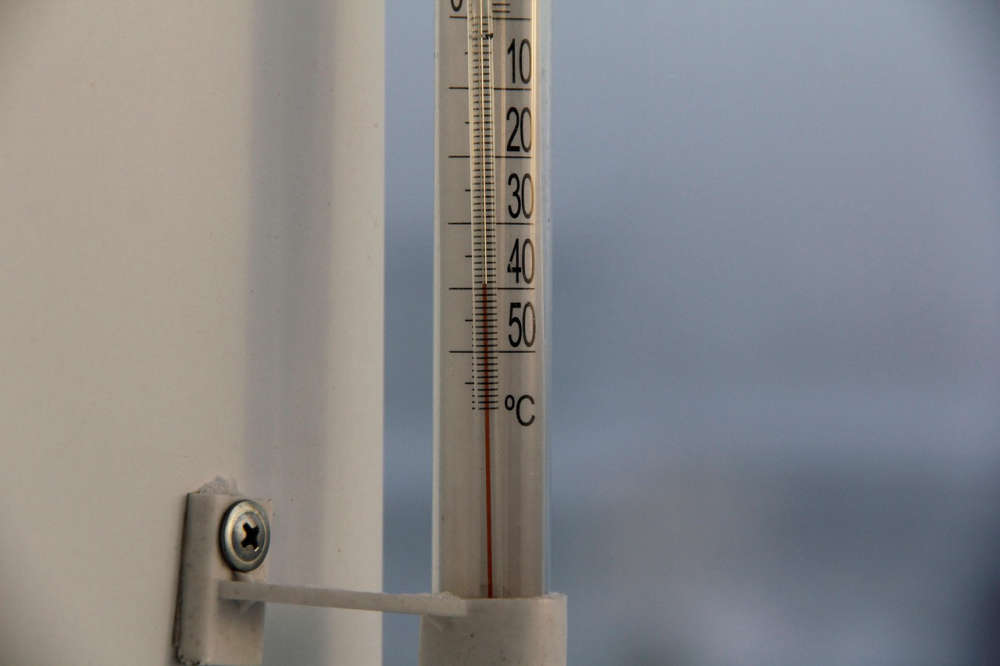

Another Cold Warning for Oxford County

Another Cold Warning for Oxford County

Chilly Charlie Returns on Monday

Chilly Charlie Returns on Monday

Khanna Shines a Light on Oxford County Superstars

Khanna Shines a Light on Oxford County Superstars

WFD Responds to Structure Fire

WFD Responds to Structure Fire

WPS Appoints New Deputy Chief

WPS Appoints New Deputy Chief

TMMC Woodstock Begins Production of Sixth Gen RAV4

TMMC Woodstock Begins Production of Sixth Gen RAV4

Oxford OPP Briefs - January 28th, 2026

Oxford OPP Briefs - January 28th, 2026

More Weather Alerts for Oxford County

More Weather Alerts for Oxford County

Thrive Oxford Honoured at ROMA

Thrive Oxford Honoured at ROMA

Tip Tuesday with the Oxford OPP - January 2026

Tip Tuesday with the Oxford OPP - January 2026

Members Needed for Tillsonburg Housing Advisory Committee

Members Needed for Tillsonburg Housing Advisory Committee

UPDATE: Ottawa Approves Plan to Move Marineland's Whales and Dolphins

UPDATE: Ottawa Approves Plan to Move Marineland's Whales and Dolphins

Comments

Add a comment