The Mayor of Zorra Township is making his cases to see gravel pits and quarries taxed fairly. Marcus Ryan met with the Parliamentary Assistant to the Minister of Finance yesterday to present options for an equitable approach to property tax assessment.

ZORRA TOWNSHIP - Zorra Township Mayor Marcus Ryan wants to see gravel pits and quarries taxed fairly.

Zorra Township is a member of the Top Aggregate Producing Municipalities of Ontario. Yesterday on their behalf, Ryan met with Parliamentary Assistant to the Minister of Finance, Stan Cho, to present options for an equitable approach to property tax assessment, so that aggregate properties can be taxed fairly.

The Municipal Property Assessment Corporation’s current property tax valuation methodology sees active aggregate operations assessed at a rate far less than single family homes and small businesses.

The assessment methodology sets an artificial cap on their property valuations, costing areas like Zorra Township hundreds of thousands in tax revenue.

In Zorra Township, typical industrial properties are assessed at between $19,000 and $26,000 per acre while aggregate operations are assessed only $8,000 per acre.

If aggregate operations were assessed at the low end of a typical industrial property, it would mean almost $1 million dollars per year in additional tax revenues for the Township. These funds are urgently required to repair and improve Zorra’s road system. Due to being home to over 50 aggregate operations, Zorra’s road infrastructure is prematurely aging.

That tax revenue is especially needed now so that municipalities can continue to provide high quality services and programs to support families and businesses in the fight against COVID19.

New Coaches Coming to Tavistock Braves

New Coaches Coming to Tavistock Braves

Norfolk OPP Investigation Leads to Charge

Norfolk OPP Investigation Leads to Charge

U14 Girls Oxford Attack Continue Season

U14 Girls Oxford Attack Continue Season

Province Increasing Speed Limit on 10 Sections of Highways

Province Increasing Speed Limit on 10 Sections of Highways

EZT Strategic Plan Survey Closing Soon

EZT Strategic Plan Survey Closing Soon

Realtors Care Food Drives Returns!

Realtors Care Food Drives Returns!

Plattsville Celebrates New Housing Complex

Plattsville Celebrates New Housing Complex

Two Have Licence Suspensions in Oxford

Two Have Licence Suspensions in Oxford

False 9-1-1 Calls Hit Norfolk County

False 9-1-1 Calls Hit Norfolk County

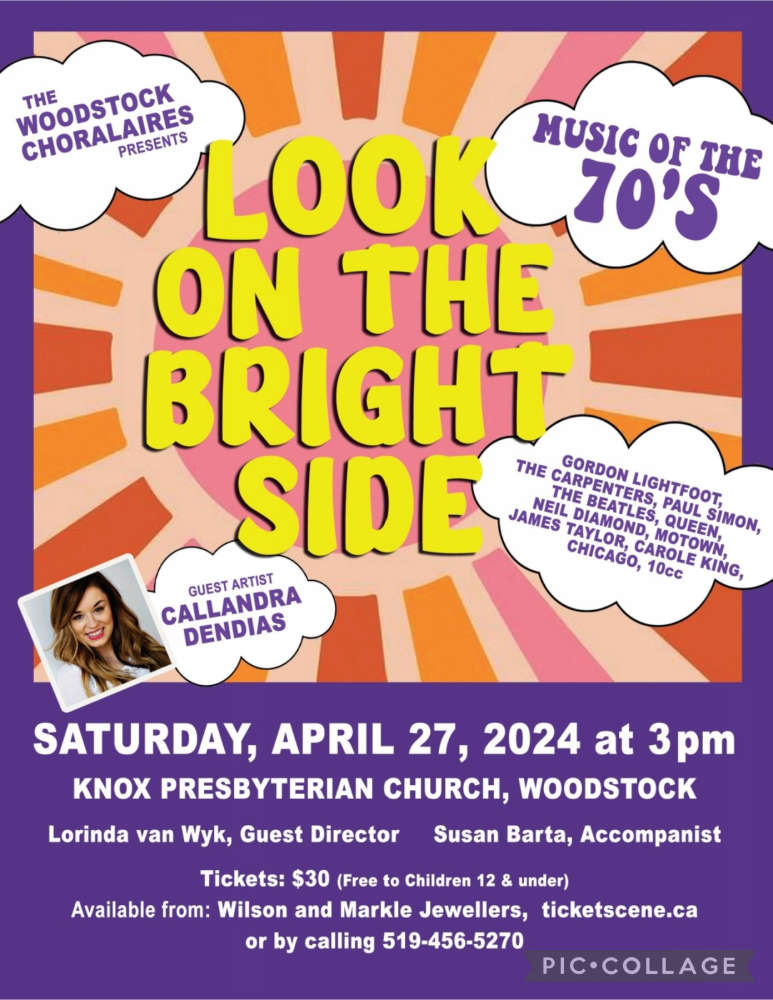

Woodstock Choralaires Hosting 70s Themed Show

Woodstock Choralaires Hosting 70s Themed Show

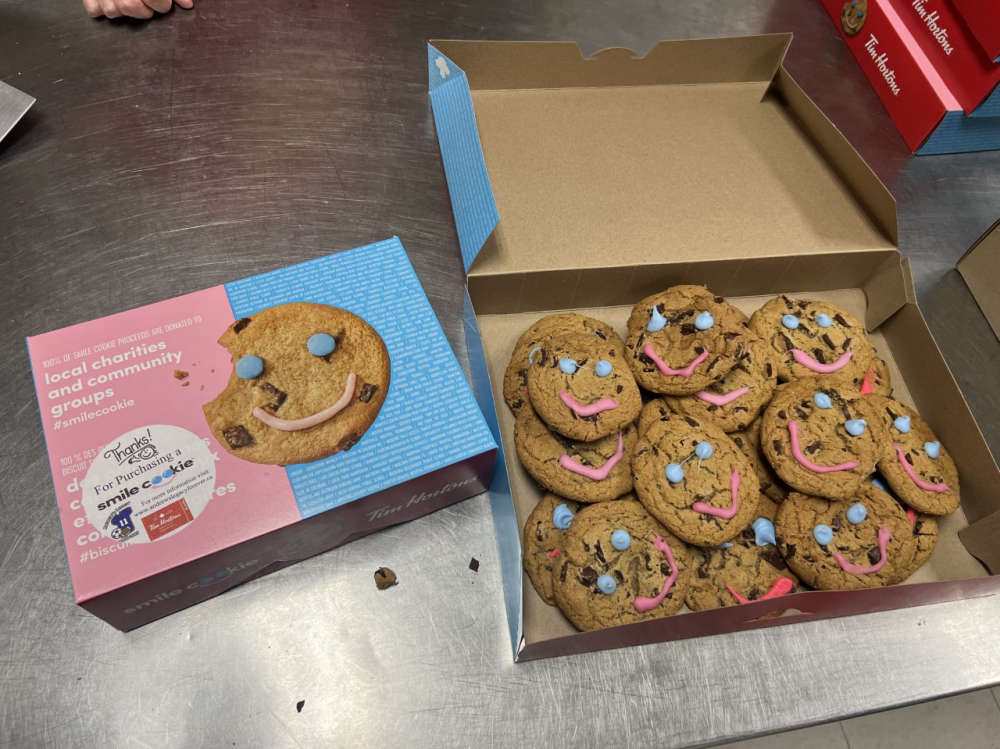

Thamesford Tim Hortons Accepting Smile Cookie Preorders

Thamesford Tim Hortons Accepting Smile Cookie Preorders

Three Vehicle Crash Investigation in Brant

Three Vehicle Crash Investigation in Brant

News Poll: Blood Donation

News Poll: Blood Donation

WCI Red Players Present: Concert for the Cure 2024

WCI Red Players Present: Concert for the Cure 2024

Oxford Resident Charged with Shoplifting

Oxford Resident Charged with Shoplifting

Earth Day is Celebrated in Woodstock

Earth Day is Celebrated in Woodstock

One Man Charged after Fraudulent Activity

One Man Charged after Fraudulent Activity

Norfolk OPP Catch Impaired Driver

Norfolk OPP Catch Impaired Driver

Woodstock Navy Club Welcomes Universal Washroom

Woodstock Navy Club Welcomes Universal Washroom

Oxford County Waste Survey Closing Soon

Oxford County Waste Survey Closing Soon

Comments

Add a comment