New home buyers in Canada will be feeling the wrath of the new mortgage stress test set to be rolled out in the new year.

OXFORD COUNTY - In less than 2 months Canada's banking regulator is set to launch its controversial mortgage stress test. The new rules will be squarely aimed at people with heavier debt loads and at least 20 per cent equity.

Julie Brenneman from The Mortgage Centre comments on what this means if your thinking of buying.

"It's going to make it more difficult all around, for any body looking to purchase at a higher purchase price then they qualify for on those new stress tests, will want to get their offer in before January 2018."

The effect of the changes will result in a 20% decrease in affordability, meaning a first-time home buyer will be able to buy 20% less house. Buyers have already been feeling the tight squeeze when looking to find lenders.

Brenneman says it's been getting more difficult for mortgage approvals.

"As of a year ago, were seeing a lot more co-signers, maybe parents coming on board to the mortgage, because they are simply not qualifying with their base wage, normally you have to be on your job for two years for us to count over-time."

Meanwhile, home sales numbered a record 1,544 units over the first ten months of 2017, that number is up 11.3% from the same period last year, which makes it a record year.

Lesley Michie, the president of the Woodstock-Ingersoll & District Real Estate Board says despite a brief slow down, sales have rebounded very strongly over the past two months.

"If you look at the numbers adjusted to account for normal seasonal patterns, sales in October were almost 60% from a quiet month of August."

The board says the average price of homes locally sold in October 2017 was $334,135, rising 6.5% from October 2016. The year-to-date average price was $339,198, up 19% compared to the first ten months of 2016.

With 121 new unit listings in October 2017, that is down 21.9% from October 2016. This was the lowest number of new listings on record for the month of October.

The new rules will now require the minimum qualifying rate for uninsured mortgages to be the greater of the five-year benchmark rate published by the Bank of Canada (presently 4.89%) or 200 basis points above the mortgage holder’s contractual mortgage rate.

Oxford MP Responds to Federal Budget

Oxford MP Responds to Federal Budget

Norfolk OPP Briefs - April 17th

Norfolk OPP Briefs - April 17th

Gas Hike on the Horizon for Ontario

Gas Hike on the Horizon for Ontario

Crime Stoppers Launches Virtual Jail & Bail Fundrasier

Crime Stoppers Launches Virtual Jail & Bail Fundrasier

Impaired Driver Busted in Ingersoll

Impaired Driver Busted in Ingersoll

Local Realtor Wins National Realtors Care Award

Local Realtor Wins National Realtors Care Award

Budget 2024 Tabled in Ottawa

Budget 2024 Tabled in Ottawa

Local U18 Girls Hockey Teams Wins Gold

Local U18 Girls Hockey Teams Wins Gold

OPP Investigate Mischief in SWOX

OPP Investigate Mischief in SWOX

WPS Searching for Stolen Truck

WPS Searching for Stolen Truck

UPDATE: Suspect Arrested in Delhi

UPDATE: Suspect Arrested in Delhi

OCL to Celebrate Oxford Local History Day

OCL to Celebrate Oxford Local History Day

OCNVA Receives Grant to Support Fishing Derbies

OCNVA Receives Grant to Support Fishing Derbies

Introducing eDash at TDMH and Alexandra Hospital

Introducing eDash at TDMH and Alexandra Hospital

Federal Budget Day on Parliament Hill

Federal Budget Day on Parliament Hill

Volunteer Board Members Needed for Local Hospitals

Volunteer Board Members Needed for Local Hospitals

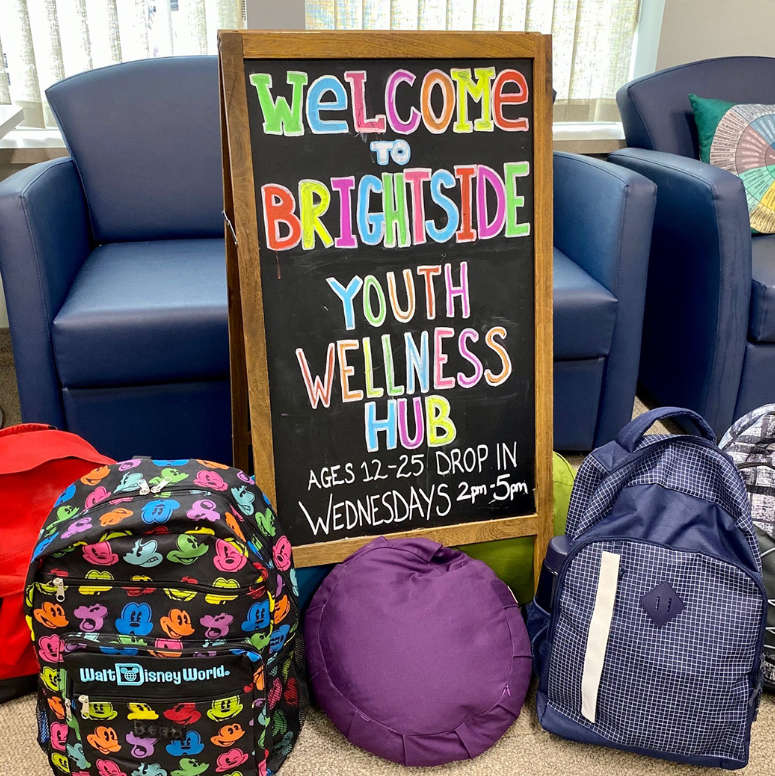

Brightside Youth Hub Set To Become Fully Funded

Brightside Youth Hub Set To Become Fully Funded

Interview with Mayor Jerry Acchione - April 15th 2024

Interview with Mayor Jerry Acchione - April 15th 2024

Trojans on the Brink of Elimination

Trojans on the Brink of Elimination

Mentors Needed for BBBS Oxford Group Programs

Mentors Needed for BBBS Oxford Group Programs

Comments

Add a comment